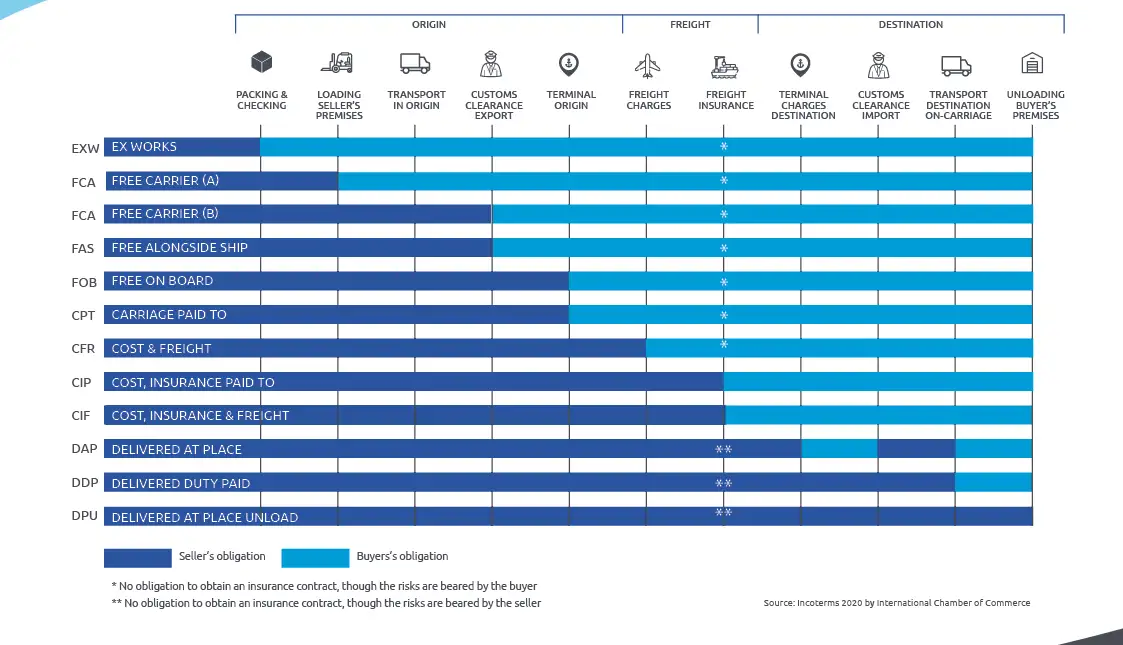

Check the list of Incoterms that came into effect in 2020, which define the responsibilities of the parties in a commercial relationship.

EXW – EX WORKS (named place of delivery)

The seller’s obligation is limited to making the goods available to the buyer at the seller’s premises or another named place, within the agreed timeframe. The seller is not responsible for export customs clearance or loading the goods onto any collection vehicle. Usable for any mode of transport. Note: Since the foreign buyer may not have the legal means to arrange export customs clearance, it is understood that this responsibility is assumed by the seller, at their own expense and risk, in the case of Brazilian exports.

FCA – FREE CARRIER (named place of delivery)

The seller completes their obligations and ends their responsibility when they deliver the goods, cleared for export, to the carrier or another person nominated by the buyer, at the named place in the country of origin. Usable for any mode of transport. Both buyer and seller may use their own transport for parts of the journey.

FAS – FREE ALONGSIDE SHIP (named port of shipment)

The seller’s obligations end when the goods are placed, cleared for export, alongside the ship nominated by the buyer, at the dock or on vessels used for loading the goods at the named port of shipment. Usable exclusively for sea transport (maritime or inland waterway).

FOB – FREE ON BOARD (named port of shipment)

The seller’s obligations and responsibilities end when the goods, cleared for export, are delivered and loaded on board the ship at the named port of shipment, both of which are designated by the buyer, on the date or within the agreed period. Usable exclusively for sea transport (maritime or inland waterway).

CFR – COST AND FREIGHT (named port of destination)

In addition to the obligations and risks outlined for FOB, the seller contracts and pays for the freight and other costs necessary to transport the goods to the agreed port of destination. Usable exclusively for sea transport (maritime or inland waterway).

CIF – COST, INSURANCE AND FREIGHT (named port of destination)

In addition to the obligations and risks outlined for FOB, the seller contracts and pays for the freight, costs, and insurance related to transporting the goods to the agreed port of destination. Usable exclusively for sea transport (maritime or inland waterway).

CPT – CARRIAGE PAID TO (named place of destination)

In addition to the obligations and risks outlined for FCA, the seller contracts and pays for the freight and other costs necessary to transport the goods to the agreed place of destination. Usable for any mode of transport.

CIP – CARRIAGE AND INSURANCE PAID TO (named place of destination)

In addition to the obligations and risks outlined for FCA, the seller contracts and pays for the freight, costs, and insurance related to transporting the goods to the agreed place of destination. Usable for any mode of transport.

DAP – DELIVERED AT PLACE (named place of destination)

The seller completes their obligations and ends their responsibility when the goods are made available to the buyer, on the date or within the agreed period, at a specified location in the destination country, ready for unloading from the transporting vehicle and not cleared for import. Usable for any mode of transport. Both buyer and seller may use their own transport for parts of the journey.

DPU – DELIVERED AT PLACE UNLOADED (named place of destination)

The seller completes their obligations and ends their responsibility when the goods are made available to the buyer, on the date or within the agreed period, at a specified location in the destination country, unloaded from the transporting vehicle but not cleared for import. Usable for any mode of transport. Both buyer and seller may use their own transport for parts of the journey. This term replaces DAT, with the difference that DAT specified “delivery” exclusively at cargo terminals, while DPU can be used at terminals or any other specified location (e.g., the buyer’s warehouse).

DDP – DELIVERED DUTY PAID (named place of destination)

The seller completes their obligations and ends their responsibility when the goods are made available to the buyer, on the date or within the agreed period, at the designated destination location in the importing country, not unloaded from the means of transport. The seller, in addition to customs clearance, assumes all risks and costs, including taxes, fees, and other charges related to importation. Usable for any mode of transport. Both buyer and seller may use their own transport for parts of the journey. Note: Because the foreign seller may not have the legal means to arrange customs clearance for the entry of goods into the country, this term cannot be used for Brazilian imports. DPU or DAP should be chosen if preferring a condition regulated by the ICC.

For more information, consult Resolution No. 16, dated March 2, 2020, published in the Diário Oficial da União (Link)